Market Timing Report

When’s the right time to invest in stocks? When markets are crashing, we worry about “catching a falling knife” and losing even more money. When markets are at all-time highs, we wonder if we shouldn’t wait to “buy the dip” and get a better price.

Answering these questions is what professional fund managers dedicate their career to, and in general they’re not very good at it: with a 2019 study from S&P500 global finding that over 89% of actively managed funds underperformed the market on a 15-year basis based on the benchmark S&P500 index. In 2008, Warren Buffet famously made a million-dollar bet with a leading hedge fund, Protégé Partners, that the S&P500 would beat their fund over ten years. In December 2017, Protégé conceded earlier: they had underperformed in the index.

If this is hard for professional fund managers, what hope is there for you, me, and all the other everyday investors? What investing strategies are most likely to lead to success?

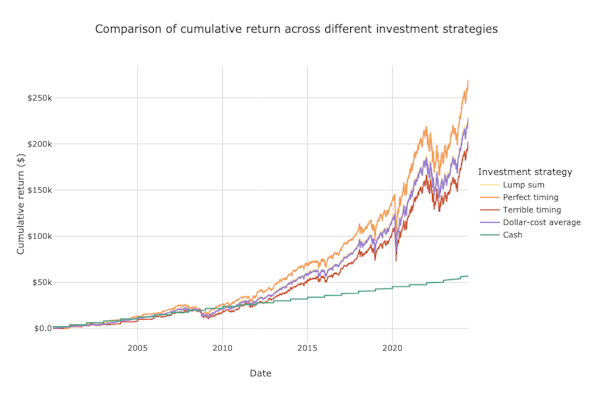

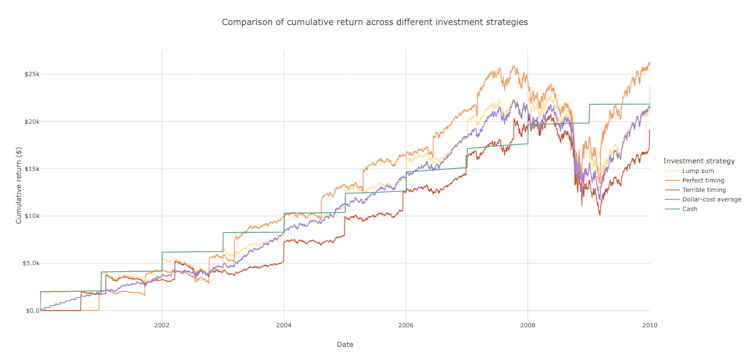

To answer this question, analysts at Charles Schwab ran a study of several different investing strategies. In this study, four investors invested $2,000 / year, every year, from January 1st, 2000, until today, each using a different strategy:

Up-front – This investor invests their $2,000 on the first day of each year

Perfect timing – This investor invests their $2,000 on the lowest day of the year, when the S&P 500 is the most affordable

Terrible timing – This investor buys at the highpoint of the S&P 500 every year

Dollar-cost averaging – This investor distributes their $2,000 investment evenly over all 12 months of the year

Staying in cash – This investor thinks the market is too risky and stays in cash, investing in money market funds at the same rate of return as the 10-year United States Treasury Bond.

Here are the results…

What’s perhaps the most impressive about this is how little market timing matters when compared to consistent investing + compounding gains over a long period. True, there’s almost a 50% difference in all-time return between terrible timing and perfect timing, it’s impossible to call the market right 100% of the time because we simply don’t know the future.

When you have money to invest, should you dollar cost-average it over time? According to this study, there’s basically no difference between the two. The only clearly losing strategy here is to stay in cash and buy fixed income.

True, from 2001 to 2009, there was a short period of time when the cash-only strategy had a better return than the market, but this was following one of the worst financial crises in U.S. history. In hindsight, 2009 was a historic opportunity to buy the market at a discount before it entered a nearly unbroken, 14-year bull market. If you stayed on the sidelines back then, you missed out. By consistently buying into the market, you ensure that you’re able to buy great companies at a discount when the opportunity arises.

Takeaways:

“Time in the market” beats “timing the market” – it’s all about consistency + long-term compounding

Historically, in the U.S., equity has compounded much more substantially than fixed-income

Storing cash in safe, fixed-income instruments is good for your emergency fund. When you’re ready to invest, for most of us, most of the time, the right answer is to buy low-cost, market-tracking ETFs with regular savings from our income.

Don't over-stress timing. Build your emergency fund and stick to your strategy. Not getting emotional through the market's ups and downs is one of the most important skills that an investor can have.

Do you still want to beat the market? We’ll talk about that in the next two posts.

*For illustrative purposes only. Does not represent an investment recommendation. For more information, please see our Social Media Disclosure.